The current pandemic and lockdowns have had a significant impact on the way we pay for goods and services. The crisis has brought to light certain trends among our customers, who are using their cards more frequently to carry out purchases in shops, online transactions (67% increase between 2019 and 2020) and contactless payments (325% increase between 2019 and 2020).

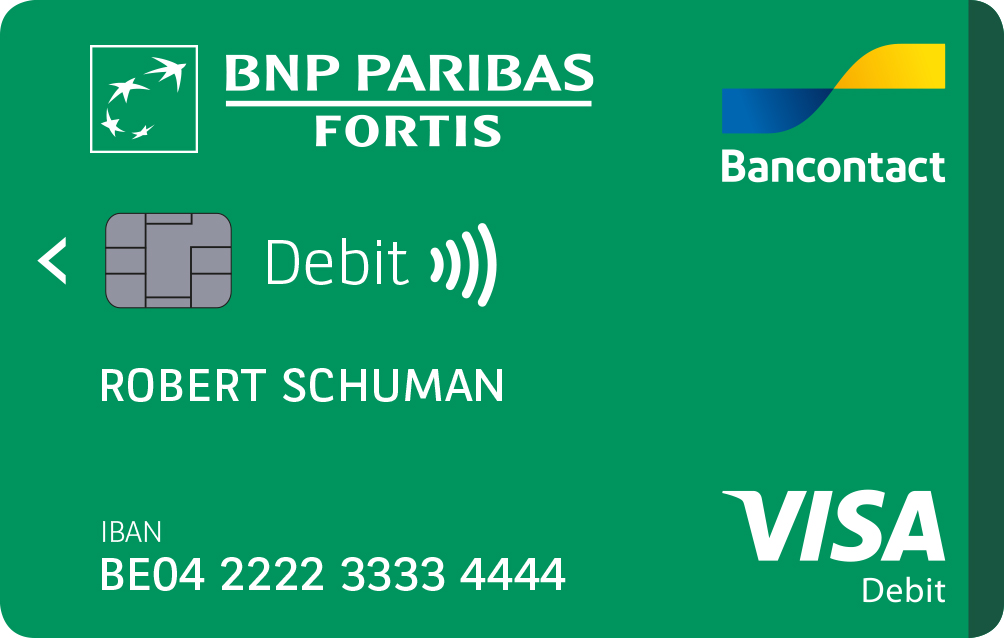

It is against this background that BNP Paribas Fortis – which already offers a comprehensive range of innovative payment solutions, comprising Apple Pay, Google Pay, Fitbit Pay, Garmin Pay and Payconiq by Bancontact, free of charge to all its customers in Belgium – is introducing Visa Debit, the debit card for all everyday purchases, into the Belgian market. From now on, Visa also offers consumers the possibility of having a debit card in Belgium.

Worldwide acceptance, both online and in-store

The new Bancontact-Visa Debit benefits from a large payment network, and will be accepted in Belgium, Europe and around the world at several million merchants, both in-store and online. This new debit card can be used wherever the Visa logo appears.

Visa Debit forms part of our efforts to develop innovative services for our customers:

- Online purchases can be confirmed in a user-friendly way using biometrics;

- Card management options (reviewing purchases, temporarily blocking the card, adjusting limits, changing its PIN etc.) will be further expanded within Easy Banking App and Easy Banking Web;

- Our customers will be able to use virtual cards (as opposed to a physical bank card) to use online or via smartphones and wearables.

"In Belgium, more than ever, the debit card is the one essential means of paying for everyday purchases,” said Michael Anseeuw, General Manager Retail Banking at BNP Paribas Fortis. “Our new Bancontact-Visa Debit card provides an optimal user experience thanks to almost universal acceptance in physical stores and online. With this innovation in the Belgian market, together with the new services available via our digital channels, we are offering the best solution for both offline and online payments.”

"Visa Debit is accepted in more than 200 countries and territories, by 70 million merchants, making it the most widely accepted debit card in the world,” added Jean-Marie de Crayencour, Country Manager Belgium and Luxembourg at Visa. "This is great news for Belgian consumers because Visa Debit will give them access to another payment method that is perfectly suited to their payment habits. We will be working on developing the Visa Debit offering in the coming months and years, so that more and more consumers can benefit from it.”

BNP Paribas Fortis customers do not need to take any action: they will automatically receive their new cards at no additional cost.

By the end of 2021, almost 4 million debit cards will be in use by our customers.

Press contacts - BNP Paribas Fortis :

Valéry Halloy

+32 (0)475 78 80 97

valery.halloy@bnpparibasfortis.com

Hilde Junius

+32 (0)478 88 29 60

hilde.junius@bnpparibasfortis.com

Press contacts - Visa :

Nicolas Daghero

+33 (0)6 85 55 05 05

dagheron@visa.com

Marlies Van Overstraeten

+32 (0)474 23 79 22

marlies.vanoverstraeten@finn.agency

BNP Paribas Fortis (www.bnpparibasfortis.com) offers the Belgian market a comprehensive range of financial services for private individuals, the self-employed, professionals, companies and public organisations. In the insurance sector, BNP Paribas Fortis works closely, as a tied agent, with Belgian market leader AG Insurance. At international level, the Bank also provides high-net-worth individuals, large corporations and public and financial institutions with customised solutions, for which it is able to draw on the know-how and international network of the BNP Paribas Group.

BNP Paribas (www.bnpparibas.com) is a leading bank in Europe with an international reach. It has a presence in 71 countries, with approximately 199,000 employees, of which more than 151,000 in Europe. The Group has key positions in its three main activities: Domestic Markets and International Financial Services (whose retail-banking networks and financial services are covered by Retail Banking & Services) and Corporate & Institutional Banking, which serves two client franchises: corporate clients and institutional investors. The Group helps all its clients (individuals, community associations, entrepreneurs, SMEs, corporates and institutional clients) to realise their projects through solutions spanning financing, investment, savings and protection insurance. In Europe, the Group has four domestic markets (Belgium, France, Italy and Luxembourg) and BNP Paribas Personal Finance is the European leader in consumer lending. BNP Paribas is rolling out its integrated retail-banking model in Mediterranean countries, in Turkey, in Eastern Europe and a large network in the western part of the United States. In its Corporate & Institutional Banking and International Financial Services activities, BNP Paribas also enjoys top positions in Europe, a strong presence in the Americas as well as a solid and fast-growing business in Asia-Pacific.

About Visa Inc.

Visa Inc. (NYSE: V) is the world’s leader in digital payments. Our mission is to connect the world through the most innovative, reliable and secure payment network - enabling individuals, businesses and economies to thrive. Our advanced global processing network, VisaNet, provides secure and reliable payments around the world, and is capable of handling more than 65,000 transaction messages a second. The company’s relentless focus on innovation is a catalyst for the rapid growth of digital commerce on any device for everyone, everywhere. As the world moves from analog to digital, Visa is applying our brand, products, people, network and scale to reshape the future of commerce. For more information, visit Visa.lu, About Visa, visa.com/blog and @VisaNewsEurope.